RBGPF

-3.4900

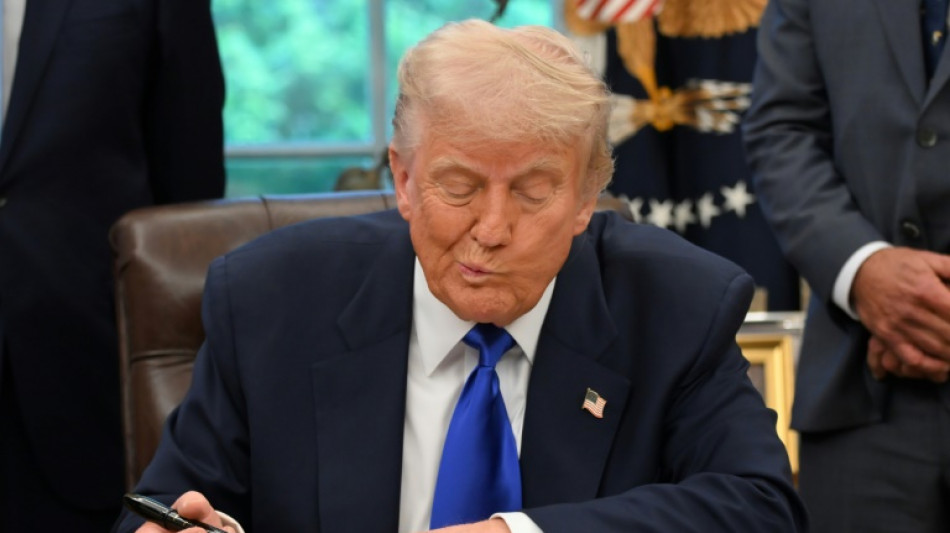

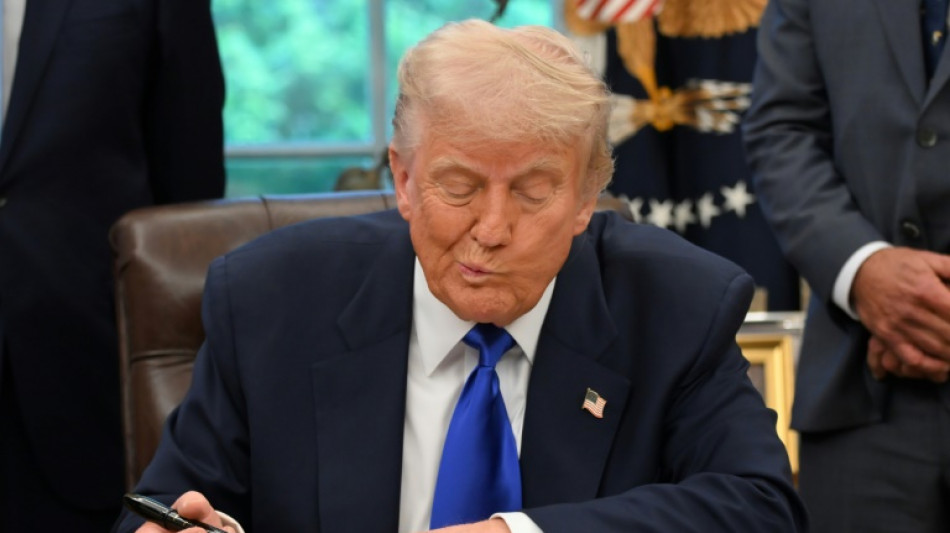

Stock markets traded mixed on Friday despite comments by US President Donald Trump suggesting he could lower tariffs on China that raised hopes weekend talks between the superpowers could lead to a de-escalation in their trade war.

Wall Street's main indices opened higher after Trump signalled that China tariffs could be lowered from 145 percent to 80 percent.

But they failed to hold onto the gains in morning trading and slipped into the red following comments by US Federal Reserve policymakers that the US economy faced higher inflation and slower growth.

Trump's comments came a day after the United States and Britain announced the first agreement since the US President launched his tariffs blitz last month.

"Coming hot on the heels of yesterday's UK-US trade deal, there is an air of optimism that we could see additional deals come to fruition around the globe," said Joshua Mahony, chief market analyst at Scope Markets.

Frankfurt's DAX rose 0.6 percent, hitting a fresh high of 23,543.27 points, recouping losses spurred by Trump's April tariffs announcements.

Paris and London also climbed following a mixed showing in Asia.

Tokyo and Hong Kong closed higher but Shanghai dropped as data showed China's exports to the United States plunged by around one fifth on-year in April as Trump's tariffs kicked in.

Oil prices jumped on hopes that easing tensions between the United States and China would alleviate fears of a slump in crude demand.

The dollar dropped after rallying on news of the US-UK trade deal.

The return of some confidence to the market boosted bitcoin, which topped $100,000 for the first time since February.

In the first trade deal since Trump's blitz of sweeping global tariffs, Washington agreed to lower levies on British cars and lift them entirely on steel and aluminium.

In return, Britain will open up markets to US beef and other farm products, but a 10-percent baseline levy on British goods remained intact.

"With the UK having basked in trade deal glory yesterday, the spotlight has now turned to China," said Russ Mould, investment director at AJ Bell.

US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer are set to meet Chinese Vice Premier He Lifeng in Switzerland this weekend -- their first formal talks since Trump raised tariffs on Chinese imports to 145 percent.

Trump told reporters he thought the talks would be "substantive" and when asked if reducing the levies was a possibility, he said "it could be".

Trump later posted that "80% Tariff on China seems right!"

That could see Beijing dial back some of its own 125 percent tariffs on US goods.

"China is America's biggest rival in the trade war and any sign of a compromise in their tit-for-tat tariff spat could be taken positively by markets," Mould added.

US Commerce Secretary Howard Lutnick warned that agreements with Japan and South Korea could take longer to reach, and that there was "a lot of work" in striking a deal with India.

In company news, shares in Commerzbank rose 3.8 percent after the German lender reported its best quarterly profit since 2011.

British airways owner IAG climbed 2.4 percent in London after it unveiled a big order for Boeing and Airbus jets and expressed optimism for air travel demand.

- Key figures at around 1530 GMT -

New York - Dow: DOWN 0.2 percent at 41,267.90 points

New York - S&P 500: DOWN less than 0.1 percent at 5,659.04

New York - Nasdaq Composite: DOWN less than 0.1 percent at 17,913.85

Frankfurt - DAX: UP 0.6 percent at 23,499.32 (close)

London - FTSE 100: UP 0.3 percent at 8,554.80 (close)

Paris - CAC 40: UP 0.6 percent at 7,743.75 (close)

Tokyo - Nikkei 225: UP 1.6 percent at 37,503.33 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 22,867.74 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,342.00 (close)

Euro/dollar: UP at $1.1263 from $1.1230 on Thursday

Pound/dollar: UP at $1.3297 from $1.3249

Dollar/yen: DOWN at 145.13 yen from 145.82 yen

Euro/pound: DOWN at 84.70 from 84.73 pence

Brent North Sea Crude: UP 1.1 percent at $63.51 per barrel

West Texas Intermediate: UP 1.1 percent at $60.59 per barrel

burs-rl/jj

S.Suzuki--JT