RBGPF

-3.4900

A formidable set of cards that includes granting access to its vast market and an ability to withstand economic pain will allow Beijing to play hardball in upcoming trade talks with the United States in Geneva, analysts say.

Trade between the world's two largest economies has nearly skidded to a halt since US President Donald Trump slapped China with various rounds of levies that began as retaliation for Beijing's alleged role in a devastating fentanyl crisis.

With additional measures justified by Trump as efforts to rebalance the trade relationship and prevent the United States from being "ripped off", tariffs on many Chinese products now reach as high as 145 percent -- with cumulative duties on some goods soaring to a staggering 245 percent.

Beijing has responded with 125 percent tariffs on US imports, along with other measures targeting American firms.

But after weeks of tit-for-tat escalation that sent global markets into a tailspin, the two powers will meet this weekend for a chance to break the ice.

Washington has said it's not expecting a "big trade deal" that could address Trump's longstanding complaint about the major goods imbalance with the export powerhouse -- but it is hoping the two sides can at least begin to de-escalate tensions.

Beijing has vowed to stick to its guns and insisted its demand that all US tariffs be lifted remains "unchanged".

Analysts say, however, China is in no major rush to make a deal.

"Beijing can impose some pain on the United States," Chong Ja Ian, associate professor of political science at National University of Singapore, told AFP.

China's core strengths going into the talks are its huge domestic market, as well as "key technologies and control of a significant proportion of processed rare earth minerals", Chong said.

- 'No wild bluster' -

Compared to its approach during Trump's first term, Beijing's response to his tariffs this time has been "more mature", said Dylan Loh, an assistant professor at Singapore's Nanyang Technological University.

"There's no wild bluster," he explained.

"I think they have learnt from their earlier responses and they know that they cannot be led by the nose," he said.

Analysts say China has been able to take more of a hardline posture to Trump's tariffs this time, despite its struggling economy.

"It still has meaningful retaliatory tools and -- just as important -- staying power," said Lizzi Lee from the Asia Society Policy Institute's Center for China Analysis.

China's autocratic system, she said, allowed it "to absorb economic pain in ways democracies often cannot".

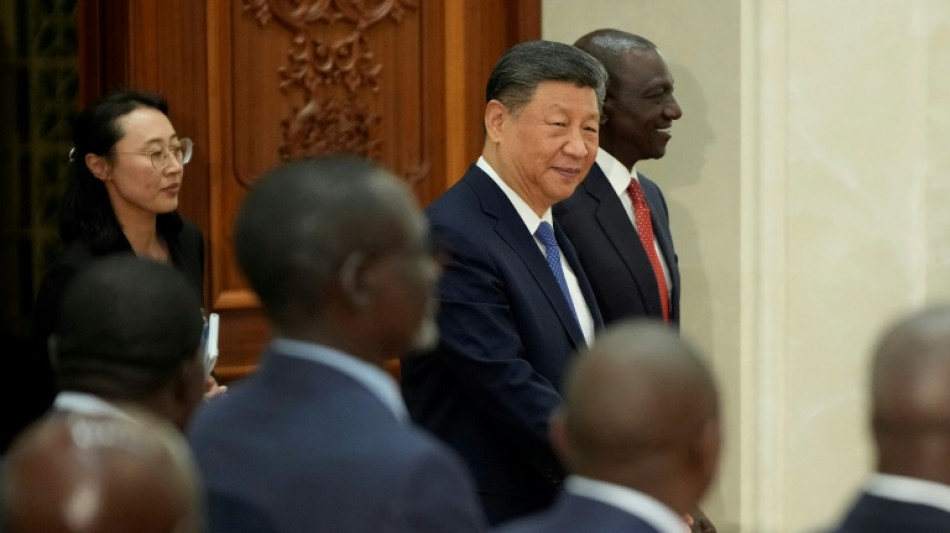

Beijing has also concurrently launched a charm offensive aimed at tightening trade ties in Southeast Asia and Europe -- positioning itself as a more stable and reliable partner in contrast to the mercurial Trump administration.

That move allowed Beijing to "build buffers" against trade war vicissitudes, Lee said.

"It won't replace the US market overnight, but every incremental diversification reduces exposure and increases negotiating room," she added.

That's not to say China isn't hurting.

Sales of Chinese goods to the US last year totalled more than $500 billion -- 16.4 percent of the country's exports, according to Beijing's customs data.

But as the effects of the trade war sunk in, China's factory activity shrank in April, with Beijing blaming a "sharp shift" in the global economy.

While not as colossal as China's export levels, US shipments to the country last year were a considerable $143.5 billion, according to the US Trade Representative website.

"Even in the case that one of the two countries would clearly have 'the upper hand', it is still worse off economically than before the trade war started," said Teeuwe Mevissen, senior China economist at Rabobank.

Beijing and Washington have "found out that it is not so easy to fully decouple".

- Talks about talks -

Policymakers this week unveiled measures to boost domestic consumption -- a sign that leaders are "not panicking but feeling some pressure", said Shehzad Qazi, managing director of China Beige Book.

Beijing will need to strap in for potentially long and drawn-out negotiations with Washington that could bring "much more volatility along the way", said Qazi.

Analysts broadly agree that upcoming talks are a first step towards a de-escalation of tensions that could, a long way down the line, lead to a lifting of tariffs.

"A best-case scenario would be agreement around a process to enter future negotiations," Ryan Hass, senior fellow at Brookings Institution, told AFP.

Beijing could insist on receiving the same 90-day waiver on tariffs that other countries had received, he suggested.

And China's insistence that the Switzerland talks came at the request of Washington suggests it is the United States that is desperate for a deal, said Dan Wang, China Director at the Eurasia Group.

"The fact that it is happening is showing some concessions already on the US side."

M.Matsumoto--JT