SCS

0.0200

Global stocks turned in a mixed performance on Tuesday as tech shares struggled and a rally on optimism over a deal to end the US government shutdown faded.

Wall Street's main indices were mostly lower in early afternoon trading, with the tech-heavy Nasdaq Composite shedding 0.8 percent.

"The go-to explanation is that there is some consternation surrounding the AI trade," said Briefing.com analyst Patrick O'Hare.

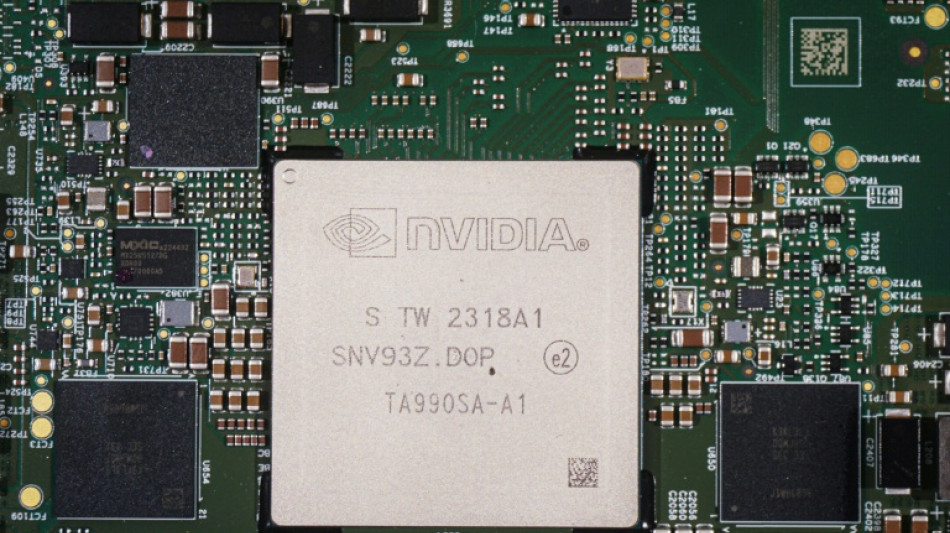

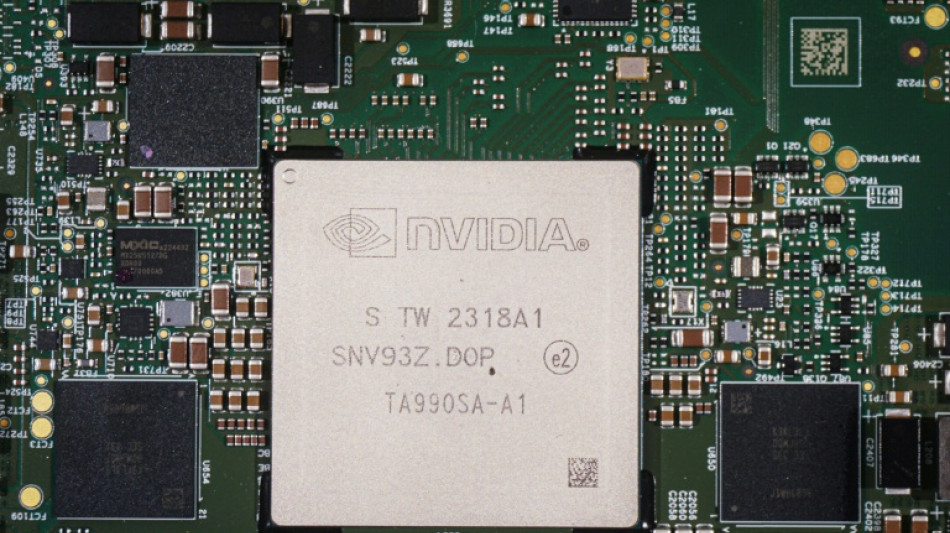

Japan's SoftBank announced earlier it sold $5.8 billion worth of shares in US chip giant Nvidia last month.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.5 percent.

The sale comes amid debate whether the inflated prices of AI stocks have become a bubble.

Kathleen Brooks, research director at XTB, noted that Softbank did not address that question, but did not want to take risks given the size of its holding.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," she said.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Shares in the so-called Magnificent Seven tech firms that includes Apple, Meta and Google-parent company Alphabet shed 1.1 percent overall.

New US economic data also hit sentiment.

"US small business optimism weakening to a six-month low and private jobs growth faltering in late October put a dampener on US indices," said analyst Axel Rudolph at IG trading platform.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars.

Paris won solid gains during a public holiday in France, which tends to exaggerate share price movements owing to low trading volumes.

An Asian rally that began Monday ran out of steam however.

Equities generally started the week on the front foot after US lawmakers reached a deal to reopen the government which has been shutdown for more than 40 days, adding to a revival of demand for tech giants despite growing fears of an AI bubble.

US senators passed a compromise budget measure on Monday after a group of Democrats broke with their party to side with Republicans on a bill to fund departments through January.

It is hoped the bill will pass the Republican-held House of Representatives and head to US President Donald Trump's desk, with some suggesting the government could reopen Friday.

Investors had been concerned about the impact of severe disruptions of food benefits to low-income households, and of air travel heading into the Thanksgiving holiday.

The shutdown has also meant key official data, including on inflation and jobs, has not been released, leaving traders to focus on private reports for an idea about the economy.

The lack of crucial data has meant the Federal Reserve has been unable to gauge properly whether or not to cut interest rates at its next meeting in December, keeping investors guessing.

- Key figures at 1630 GMT -

New York - Dow: UP 0.4 percent at 47,570.52 points

New York - S&P 500: DOWN 0.3 percent at 6,813.03

New York - Nasdaq Composite: DOWN 0.8 percent at 23,337.34

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1595 from $1.1563 on Monday

Pound/dollar: DOWN at $1.3169 from $1.3182

Dollar/yen: DOWN at 154.00 yen from 154.03 yen

Euro/pound: UP at 88.04 pence from 88.00 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.7 percent at $61.17 per barrel

burs-rl/tw

K.Inoue--JT