SCS

0.0200

While the world economy faces instability from US President Donald Trump's threats of a global trade war, the International Finance Corporation (IFC) is dramatically ramping up its investment activities.

The Washington-based IFC -- the World Bank's private sector arm -- mobilizes private capital and provides financing to support businesses across emerging economies.

Though not widely known outside development circles, the organization plays a crucial role in creating jobs and supporting growth in less developed regions.

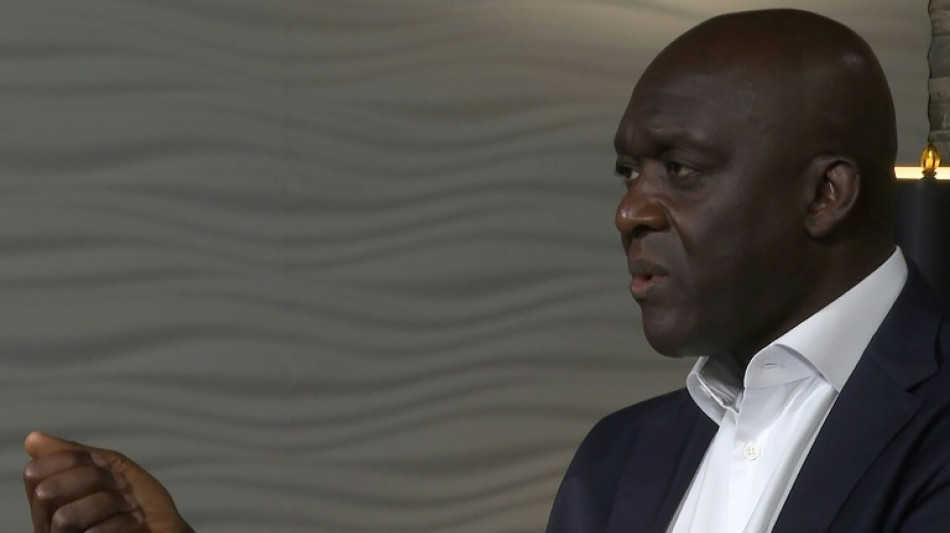

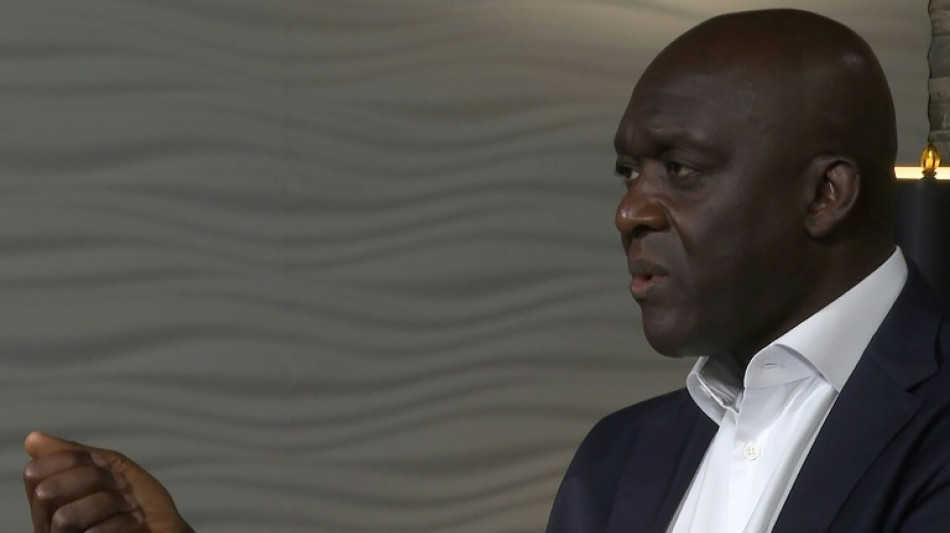

"The world economy has been going through a bit of a turbulent time, but what I must say is that even though there is turbulence... we are seeing a lot of interest in investing in emerging countries," Makhtar Diop, the IFC's managing director, told AFP.

This optimism is backed by concrete numbers. In the fiscal year ending June 30, preliminary data shows that the IFC committed over $71 billion -- nearly double its commitment from just three years ago and a significant jump from last year's record of $56 billion.

The investment spans the globe, with more than $20 billion flowing to Latin America, $17 billion to Asia, and $15.4 billion to Africa.

The dramatic increase stems from a deliberate strategic shift.

Diop, an economist and former Senegalese finance minister, explained that the IFC has focused on becoming "simpler, more agile, and delegating decision-making to our teams that are in the field."

This approach abandons the over-centralized structure that previously "was slowing down our ability to respond and seize new opportunities."

The timing is significant. As Western economies pull back from direct aid to developing countries -- constrained by mounting debts, rising defense budgets, and increasingly inward-looking politics -- the IFC has accelerated.

"It's totally understandable that they have fewer resources to make available in the form of grants to developing countries," Diop acknowledges.

However, he emphasized that World Bank funding for the world's poorest countries remains fully replenished, calling it "the most efficient and best way to support countries."

The IFC's expanding role within the World Bank Group is evident. Today, its funding nearly matches the support the bank provides directly to governments, making it an equal partner in development efforts.

- Dubai to Africa -

The organization is also attracting new types of investors.

Many co-financing partners now come from regions that traditionally haven't invested outside their home areas. The IFC's largest renewable energy investment in Africa, for example, was completed with a Dubai-based company.

These investors trust the IFC not only for its market knowledge but also for the risk-mitigation tools it offers, Diop said.

In Africa particularly, the IFC pursues a strategy of identifying and supporting "national champions" -- successful local companies that need help to become more competitive and globally integrated.

A significant portion of the IFC's mandate involves sustainability projects, an area where Diop decries debates with false choices between economic development and the environment, especially in electricity projects that form an important part of the agency's portfolio.

"It happens that today, you don't have to make that trade-off because the sustainable solutions are often the cheaper ones, and that's the beauty of what we are seeing," he said.

While fossil fuel generation remains part of the energy mix to ensure grid stability, the economics increasingly favor clean alternatives.

Behind all these investments lies an urgent demographic reality: 1.2 billion young people will reach working age in developing countries over the next decade.

For the World Bank, creating employment for this massive cohort is paramount.

"The first question of any leader you meet from the developing world is how can you help to create jobs for young people?" Diop observed.

Beyond infrastructure development that stimulates broader economic activity, Diop identifies tourism, pharmaceuticals, and agriculture as the most promising sectors for job creation.

These industries can offer the scale and growth potential needed to absorb the coming wave of young workers entering the global economy.

T.Kobayashi--JT