SCS

0.0200

The US Federal Reserve is widely expected to extend a recent pause in rate cuts this week as it waits to see how President Donald Trump's stop-start tariff rollout affects the health of the world's largest economy.

Trump has imposed steep levies on China, and lower "baseline" levies of 10 percent on goods from most other countries, along with 25 percent duties on specific items like steel, automobiles and aluminum.

The president has also paused higher duties on dozens of other trading partners until July to give them time to renegotiate existing arrangements with the United States.

Most economists expect the tariffs introduced since January to push up prices and cool economic growth -- at least in the short run -- potentially keeping the Fed on hold for longer.

"The Fed has to be very focused on maintaining inflation so that it doesn't start moving back up in a more persistent way," said Loretta Mester, who recently stepped down after a decade as president of the Cleveland Fed.

"That would undermine all the work that was done over the last three years of getting inflation down," she told AFP.

- 'Good place to be' -

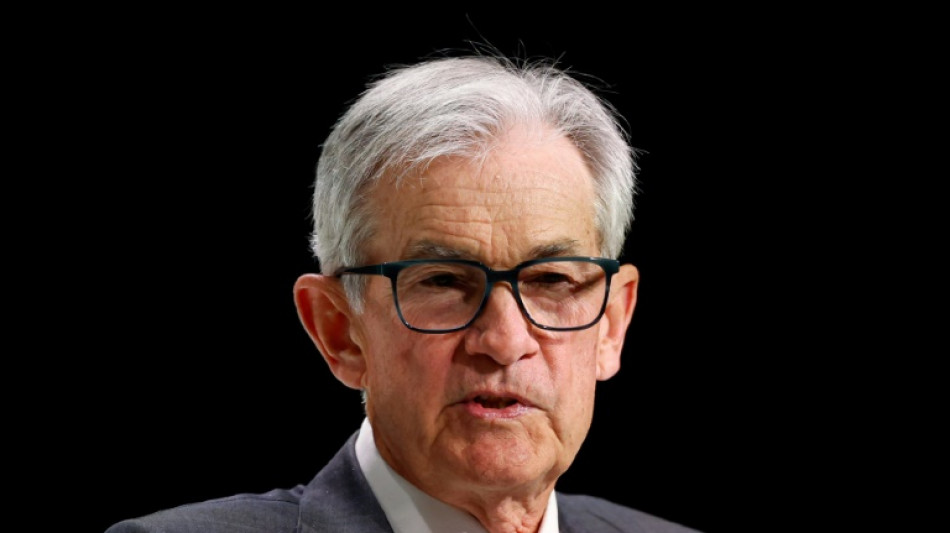

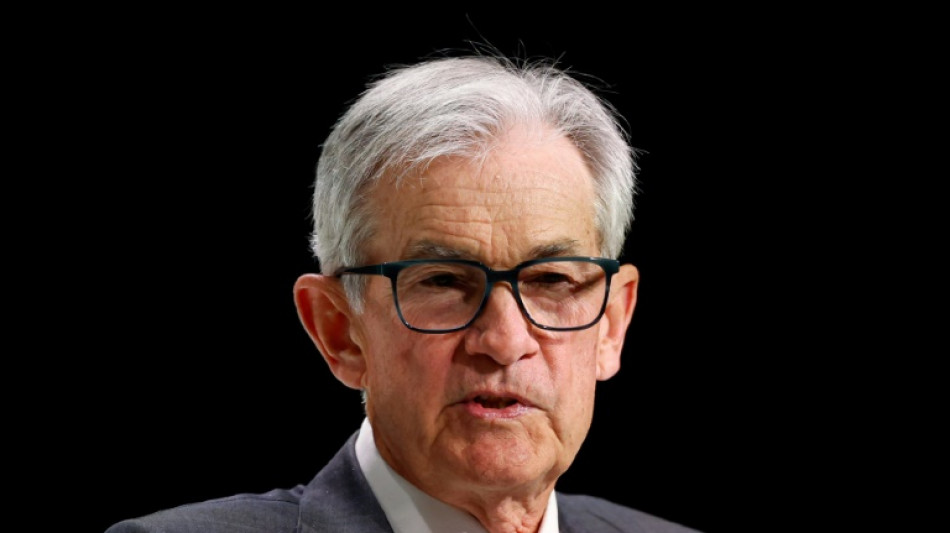

Trump reiterated his call for Fed chair Jerome Powell to lower rates in an NBC interview published in full on Sunday, claiming the decision not to do so was largely personal.

"Well, he should lower them. And at some point, he will. He'd rather not because he's not a fan of mine," Trump said.

The Fed has held its key interest rate at between 4.25 percent and 4.50 percent since December, as it continues its plan to bring inflation to the bank's long-term target of two percent, with another eye firmly fixed on keeping unemployment under control.

Recent data points to the Fed's inflation remaining broadly on track ahead of the introduction of Trump's "Liberation Day" tariffs, while unemployment has remained relatively stable, hugging close to historic lows.

At the same time, various "softer" data points such as consumer confidence surveys have reflected a sharp decline in optimism about the health of the US economy -- and growing concerns about inflation.

"Whether the economy enters a recession or not, it's hard to say at this point," said Mester, now an adjunct professor of finance at the Wharton School of the University of Pennsylvania.

"I think the committee remains in good condition here, and most likely they'll remain on hold at this meeting," said Jim Bullard, the long-serving former president of the St. Louis Fed.

"I think it's a good place for them to be while there's a lot of turbulence in the trade war," added Bullard, now dean of the Daniels School of Business at Purdue University.

Financial markets overwhelmingly expect the Fed to announce another rate-cut pause on Wednesday, according to data from CME Group.

- Pushing back rate cuts -

US hiring data for April published last week came in better than expected, lowering anxiety about the health of the labor market -- and reducing pressure on the Fed's rate-setting committee to reach for rate cuts.

Economists at several large banks including Goldman Sachs and Barclays subsequently delayed their expected date for rate cuts from June to July.

"Cutting in late July allows the committee to see more data on the evolution of the labor market, and should benefit from resolving uncertainty about tariffs and fiscal policy," economists at Barclays wrote in a note to clients published Friday.

Other analysts see rate cuts happening even later, depending on the effects of the tariffs.

"A slower reaction to economic weakness" could happen "if backward-looking data gives the impression of resilient demand while inflation gauges heat up," wrote EY Chief Economist Gregory Daco.

The rise in longer-run inflation expectations in the survey data points to growing concerns that tariff-related price pressures could become embedded in the US economy -- even as the market-based measures have remained close to the Fed's two percent target.

"I would be sort of in the camp (saying) prove to me that they're not going to be inflationary," Mester said of tariffs, adding that it would be "unwise" to assume that inflation expectations were stable, given the recent survey data.

But Bullard from Purdue took a different view, stressing the stability of the market-based measures.

"I haven't liked the survey-based measures of inflation expectations, because they seem to be partly about inflation but partly about many other issues, maybe, including politics," he said.

"This is a moment where you might want to look through the survey-based measures that are talking about very extreme levels of inflation that don't seem likely to develop near-term," he added.

T.Sato--JT